Laws of the Land

The year in bitcoin laws so far:

160 total measures have been introduced (including bills and executive orders).

48 ‘SBR’ measures have been introduced (direct investment and/or creation of reserve funds).

19 SBR measures are currently alive (in process or enacted).

Turning to the State Reserve Race, we now have four bills across the finish line: the already-enacted measures in Texas, New Hampshire and Arizona, plus the newly passed Arizona bill discussed below.

There are reserve bills still in flight in five more states: Massachusetts, Michigan, Ohio, Rhode Island, and North Carolina. However, Rhode Island is likely to drop off the board, as the legislative session ends in three days time on 6/30.

Top Stories

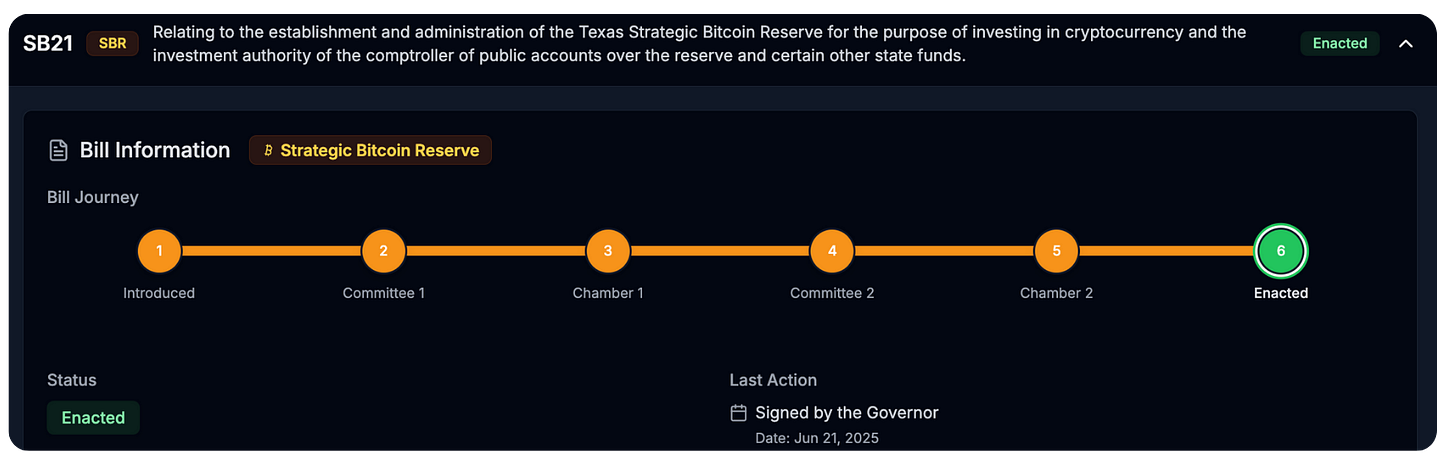

Texas Strategic Bitcoin Reserve Enacted

Texas made history this week. Governor Greg Abbott signed Senate Bill 21 into law, officially enacting the legislation to provide Texas with its Strategic Bitcoin Reserve.

SB 21 was a broadly bipartisan bill. Authored by Sen. Charles Schwertner [R] and sponsored by Rep. Giovanni Capriglione [R] in the House, it also attracted six Democrat co-sponsors.

The bill ultimately received bipartisan support in both chambers, passing through the Senate 25 - 5, and the House 101 - 42.

For the complete vote records, visit our Texas page.

Details of the bill

Investment: The Reserve will be funded through legislative appropriation ($10m has already been earmarked).

While the fund is called the “Texas Strategic Bitcoin Reserve”, it technically allows for other digital assets to be included. However, the threshold for consideration is that they must achieve a $500 billion market cap, averaged over two years.

Given that no other digital asset has ever even crossed the threshold, the reserve will function as bitcoin-only for the foreseeable future.

Management: The bill creates a special fund outside the treasury managed by the state Comptroller, and also a five member Texas Strategic Bitcoin Reserve Advisory Committee to advise on investment policies.

Custody & Reporting: The bill allows the Comptroller to contract with a qualified third party custodian that employs cold storage.

Congress Seeks Clarity on Market Structure

Several major developments happened this week relating to long-sought after ‘Digital Assets Market Structure’ legislation at the federal level.

First, the House Agriculture and Financial Services Committees reported their passage of the CLARITY Act: the bill which (among other things) aims to once and for all ‘clarify’ when digital assets are either securities or commodities, thereby establishing clear regulatory boundaries for the SEC and CFTC, respectively.

Meanwhile, the Senate is taking a stab at clarifying things too, with the Committee on Banking, Housing, and Urban Affairs (chaired by Sen. Cynthia Lummis) releasing their ‘Principles for Market Structure Legislation’. The Principles broadly overlap and are consistent with the CLARITY Act.

On Tuesday, the Banking Committee’s Subcommittee on Digital Assets then hosted a panel hearing called “Exploring Bipartisan Legislative Framework for Digital Assets Market Structure”.

The panel consisted of several representatives from industry, academia, and former regulators who all testified in support of establishing clear ‘rules of the road’ for the crypto industry.

Then yesterday, the Banking Committee hosted a fireside chat to discuss the Principles further, the major takeaways from which are:

Both Senate and White House support seems to be for passing standalone market structure legislation (rather than combining with the GENIUS Act for stablecoins, which some industry factions are reportedly pushing for).

A timeline is now emerging which targets the end of September for getting it across the finish line, as set out by Whitehouse Crypto Czar David Sacks yesterday:

Bills in Brief

Arizona passed another ‘Bitcoin Reserve’ bill, this one specifically for assets forfeited in criminal proceedings. House Bill 2324 is now on the desk of Governor Katie Hobbs, who has a mixed record this session: signing one reserve bill (HB 2749, for ‘unclaimed property’), and vetoing two others which were for direct state investment (SB 1373 and SB 1025).

Texas updated its Civil Asset Forfeiture law to include digital assets, with Senate Bill 1498. The bill allows the state to seize digital assets tied to criminal offenses. Proceeds though will go to a special forfeiture fund, not the Strategic Reserve just created by SB 21.

Oregon enacted Senate Bill 146, updating the state’s unclaimed property laws to include digital assets. Digital assets are treated as abandoned after three years of dormancy, and are remitted to the state to then be reclaimed by the owners.

Louisiana enacted House Bill 483, a law to create a licensing and consumer protection regime for ‘kiosks’ (i.e. cryptocurrency ATMs).

Rhode Island also enacted a kiosk law focused on licensing and fraud mitigation, Senate Bill 0016. It mandates that kiosk operators hold a state money-transmitter license, and implement a variety of consumer protection measures.

New Hampshire enacted House Bill 310, creating a 9-member commission to study Stablecoins and Tokenized Real World Assets. The commission will examine the current regulatory landscape, analyze legal and technological considerations, identify best practices from other jurisdictions, and evaluate economic opportunities.

The US House passed the ‘Deploying American Blockchains Act’, House Bill 1664. The bill makes the Secretary of Commerce the President’s lead advisor on crypto, and it requires the Commerce Dept. to: craft policies to boost U.S. competitiveness in the industry, coordinate federal agencies, issue guidance, and support open-source infrastructure.

That’s it for the Bitcoin Laws Brief this week.

Here’s a bonus though: catch me below talking through some of the most pressing issues on policy, and bitcoin generally, on Roxom TV’s Blockchain Report.

Catch you again next Friday.